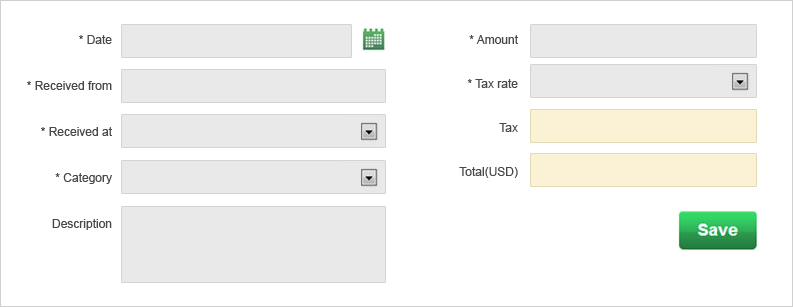

You can record your income information at your customer's place or do it at your own leisure later in the day.Your accounting moves with you!

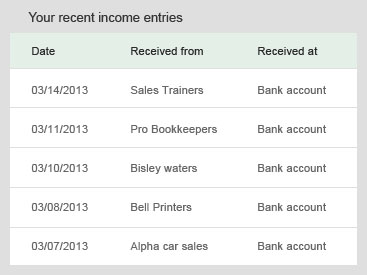

You can view all your recent income entries at a quick glance. You will quickly realise if your income is on track or if you need to push a little harder

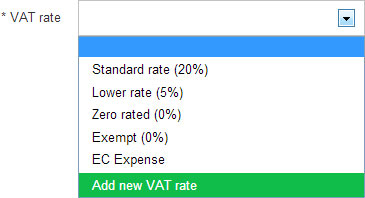

Handdy allows you to add or edit your tax rate based on your business. You can a add different VAT or sales tax rates and you can do that in seconds

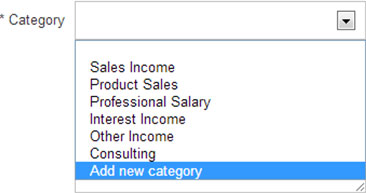

All standard income categories are pre built in Handdy. On top of that you can either edit it or add a new category to suit your business

You can export all your income data for any time period in to excel and send it to your accountant in just 1 click. It will be properly categorized and arranged. Your accountant will love you for making his life simple

Are you a small business owner with minimal accounting knowledge? Now manage your books with Handdy accounts – easy to use accounting software especially built for small business owners with customizable options. Start your unlimited free version today.

Try it for FREE View pricingBusiness expenses slipping through the net is a problem for many small business owners. No matter how good you are with your accounting, some expenses invariably slip through the net. Business expenses slipping through and not being accounted means you end up paying more taxes than necessary.

To stop business expenses slipping through, small businesses are now switching to online accounts software. Using the traditional desktop accounts software, you can only enter the expenses after you come back to your work desk. However, using online accounts software such as Handdy, you can record your expenses from wherever you are.

Recording business expenses from anywhere is great boon for small business owners. Recording every single expense no matter how small it is helps small business owners pay right amount of tax and nothing in excess. If you want to stop your expenses from slipping through switch to Handdy online accounts software today.